Renting vs. Buying: A $1.6 Million Difference

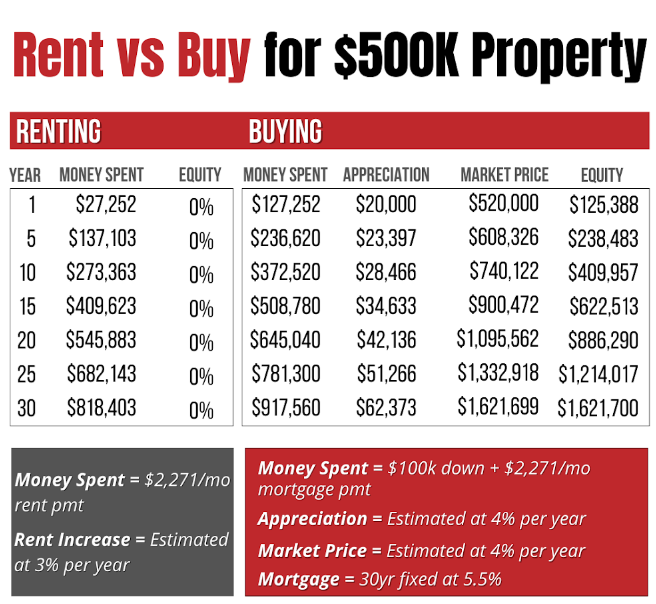

Let’s look at the financial impact of renting vs. buying over 30 years using a real-life example. Imagine two people living in the same 2-bedroom condo, paying the same monthly fees, except one rented and one bought.

The Renter: Over 30 years, the renter spends a staggering $818,403 on rent. Despite all those payments, the renter ends up with $0 equity—none of that money contributed to building wealth. On top of that, the rent increases by an average of 3% per year, making it harder to keep up with rising costs.

The Buyer: The buyer, on the other hand, starts with a $100,000 down payment (perhaps saved or gifted by a family member) and pays the same $2,271 monthly payments over 30 years. However, there's one huge difference. After 30 years, the buyer now owns an asset worth $1,621,700.

Thanks to the power of appreciation, the home’s value grows by an average of 4% annually. After 30 years, the condo’s market price rises to $1,621,699. The buyer now owns a fully paid-off home worth over $1.6 million, with 100% equity.