What is a CAP Rate?

A cap rate, or capitalization rate, is the percentage that measures the return on an investment based on its net income compared to its value. It’s a useful tool for comparing different investments.

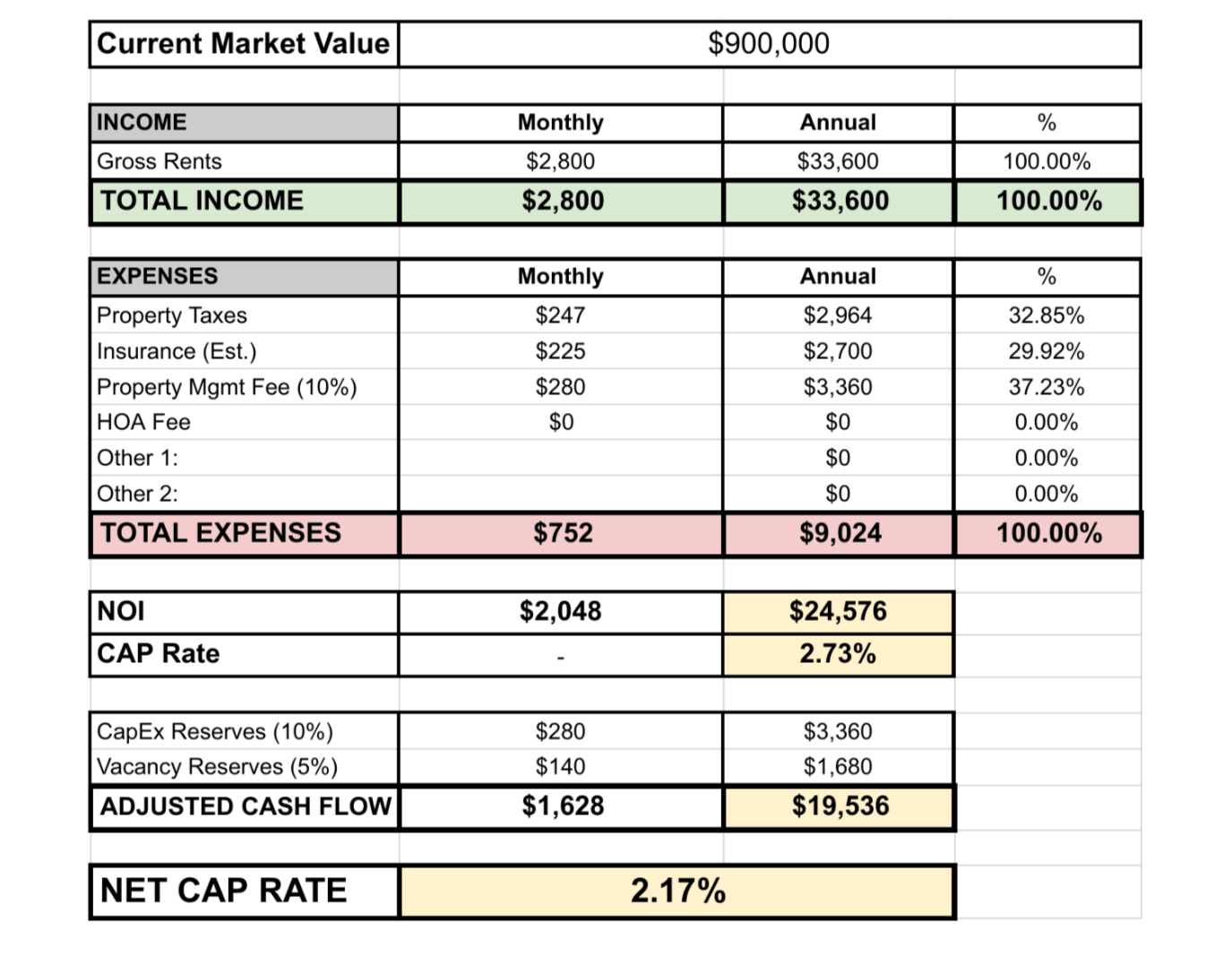

For example, if you own a $900,000 property and it generates $24,576 in net income annually, the cap rate would be 2.73%, meaning your annual net return is 2.73% of the asset's value. When you consider CapEx reserves and vacancies your Net Cap Rate lowers to 2.17%

When clients hear they are only getting a 2.17% return on their money they are shocked. After clients learn their rate of return, most people want to liquidate their underperforming properties and invest in higher-yielding properties. We help clients invest in properties that have a 4-5% CAP rate which would instantly double your monthly rental income.

If making more money isn’t your top priority, we can help you create a plan to bless your loved ones or what matters most to you.